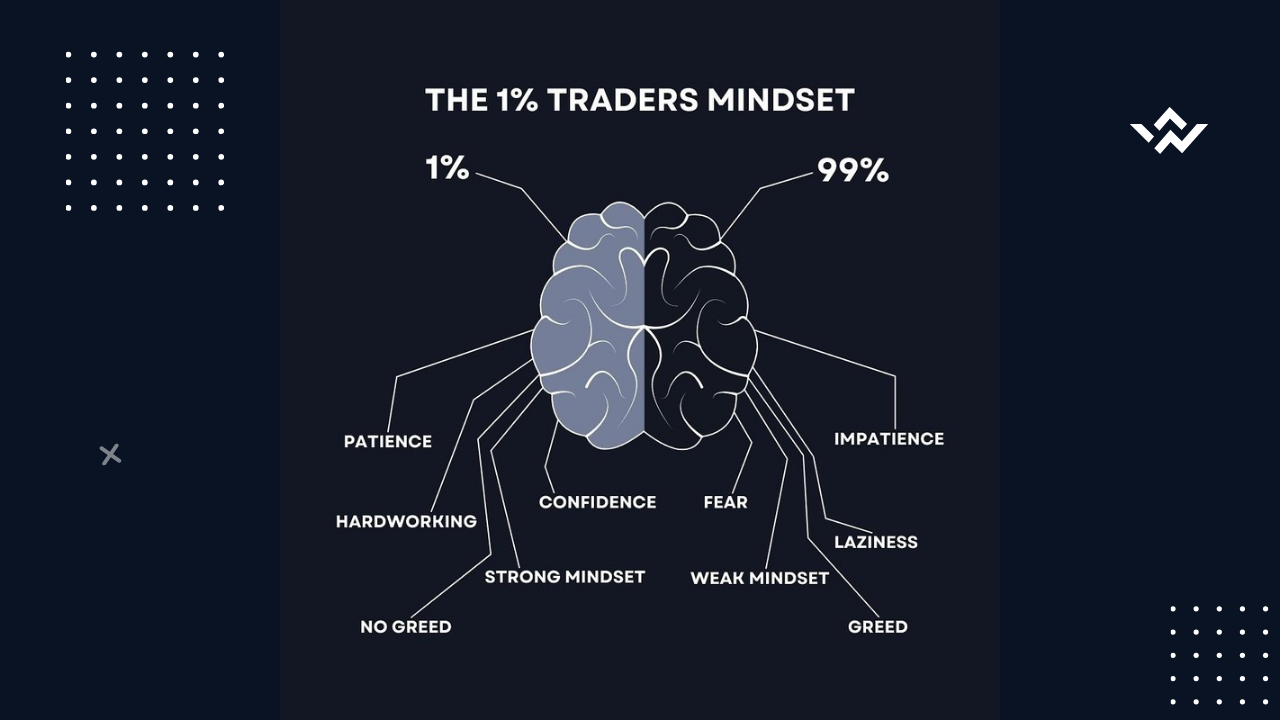

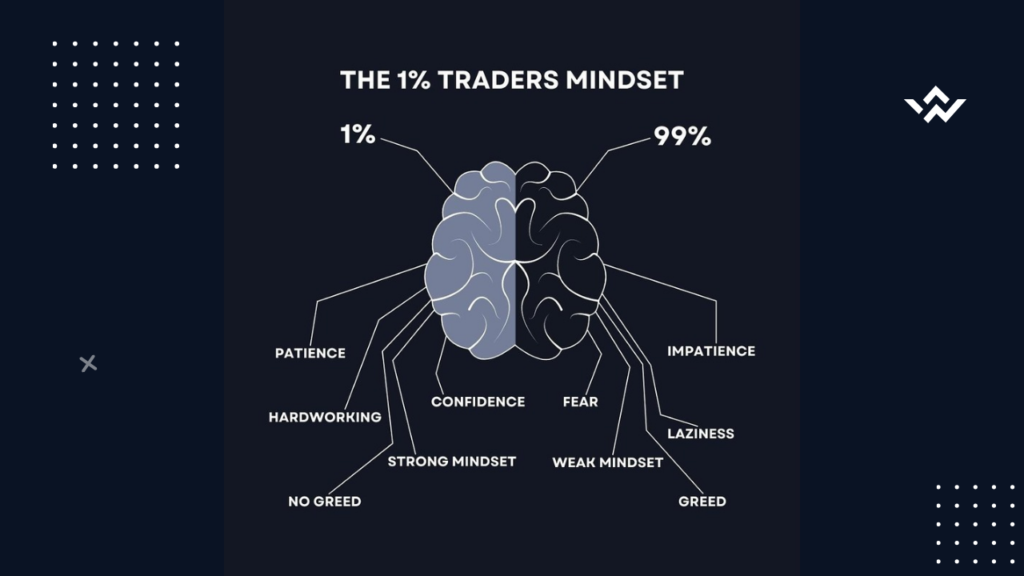

In the high-stakes world of trading, only the 1% Traders Mindset separates the elite from the crowd. These top performers don’t rely on luck—they’ve mastered a unique psychological framework that fuels consistent success. But what exactly defines this mindset? Let’s dive into the seven core traits that shape the 1% and how you can adopt them to dominate the markets.

What is the 1% Traders Mindset?

The 1% Traders Mindset isn’t about complex strategies or insider knowledge. It’s a mental framework built on discipline, emotional control, and relentless focus. While 99% of traders fall prey to fear, greed, and impulsivity, the 1% thrive by balancing opposing traits. Below, we break down the critical dualities that define this elite mindset.

1. Patience vs. Impatience: The Art of Waiting for Perfection

Impatient traders chase every market fluctuation, often entering or exiting trades too early. In contrast, the 1% Traders Mindset prioritizes patience. They wait for high-probability setups, like a chess player planning ten moves ahead.

Warren Buffett famously said, “The stock market is a device for transferring money from the impatient to the patient.” By resisting FOMO (Fear of Missing Out), the 1% avoid costly mistakes. For example, legendary trader Paul Tudor Jones waited months for the 1987 crash to unfold, securing a 200% return by sticking to his plan.

Pro Tip: Use tools like TradingView to set alerts for key price levels—this reduces impulsive decisions.

2. Confidence vs. Fear: Trusting Your Edge

Fear paralyzes average traders, causing them to second-guess strategies or exit winning trades too soon. The 1% Traders Mindset thrives on confidence rooted in preparation. They backtest strategies rigorously and stick to their rules, even during drawdowns.

Take Jesse Livermore, who shorted the 1929 market crash. Despite widespread panic, his confidence in his analysis led to a $100 million profit (adjusted for inflation).

Action Step: Build confidence by journaling every trade. Reviewing past successes reinforces trust in your system.

3. Hard Work vs. Laziness: The Grind Behind the Glory

Many assume trading is a “get-rich-quick” scheme. The 1% know better. They treat trading like a business, dedicating hours to research, analysis, and self-education.

For instance, Ray Dalio, founder of Bridgewater Associates, starts his day at 5 AM, analyzing global macroeconomic trends. His book Principles emphasizes relentless improvement—a pillar of the 1% Traders Mindset.

Resource: Read Market Wizards by Jack Schwager for insights into top traders’ work ethics.

4. Strong Mindset vs. Greed: Knowing When to Walk Away

Greed clouds judgment. The 1% avoid overtrading or holding positions for “just a little more profit.” Instead, they follow strict risk-reward ratios.

Consider George Soros’s 1992 bet against the British Pound. He risked $10 billion but exited once his profit target was hit, netting $1 billion in a single day.

Rule of Thumb: Never risk more than 1-2% of your capital per trade.

5. Adaptability vs. Stubbornness: Pivoting with the Market

Markets evolve, and so must traders. The 1% Traders Mindset embraces adaptability. When a strategy underperforms, they tweak it—they don’t double down out of ego.

For example, Stanley Druckenmiller adjusted his bullish stance on tech stocks before the 2000 dot-com crash, saving his fund from massive losses.

6. Emotional Detachment vs. Overattachment: Trading Without Ego

The 1% view losses as feedback, not failure. They cut losing trades quickly, avoiding the sunk-cost fallacy.

Case Study: After losing $500 million in the 1998 Russian debt crisis, John Paulson recalibrated his strategy and made $15 billion betting against subprime mortgages in 2007.

7. Continuous Learning vs. Complacency: Staying Ahead of the Curve

The 1% never stop learning. They study market history, psychology, and emerging trends.

Resource: Enroll in Coursera’s Financial Markets course by Yale University to deepen your knowledge.

Conclusion: How to Cultivate the 1% Traders Mindset

Adopting the 1% Traders Mindset requires deliberate practice and self-awareness. Start small: focus on one trait (e.g., patience) for 30 days. Track progress in a journal, celebrate wins, and learn from losses.

Remember, even the 1% started as beginners. As Mark Douglas wrote in Trading in the Zone, “Consistency starts in the mind.”

Ready to level up? Explore our guide on risk management strategies to further sharpen your edge.

By embedding these principles into your daily routine, you’ll join the ranks of traders who don’t just survive—they thrive. The 1% Traders Mindset isn’t a destination; it’s a journey of relentless growth. Start yours today. 🚀