Retirement planning can often feel overwhelming, but what if I told you that with a little discipline and the right strategy, you could secure ₹10 crore by the time you hit 60? Yes, you read that right! Systematic Investment Plans (SIPs) in mutual funds can be your golden ticket. Let’s break down how you can achieve this ambitious goal.

The Magic of Compounding

Before delving into the specifics, it’s essential to understand the power of compounding. Simply put, compounding means earning returns not just on your initial investment but also on the gains you accumulate over time. This “interest on interest” phenomenon can work wonders for your wealth accumulation, especially when you start early.

Why SIPs?

SIPs allow you to invest a fixed amount regularly, making it easier to manage your finances. Whether it’s ₹3,000 or ₹30,000 a month, SIPs can fit into any budget. The beauty of this approach lies in its flexibility and the ability to benefit from market fluctuations without the stress of timing the market.

SIPs (Systematic Investment Plans) offer several key advantages:

- Rupee Cost Averaging: By investing fixed amounts regularly, you buy more units when prices are low and fewer when prices are high, reducing market timing risk.

- Disciplined Investing: Automates savings and investment, helping investors consistently build wealth without emotional decision-making.

- Low Entry Barrier: Allows investors to start with small amounts (often as low as ₹500 monthly), making investment accessible to more people.

- Compounding Benefits: Regular investments harness the power of compounding, potentially growing wealth significantly over time.

- Flexibility: Investors can increase, decrease, or pause contributions based on their financial situation.

Particularly effective for mutual funds and equity investments, SIPs help individual investors develop a structured approach to long-term wealth creation.

The Path to ₹10 Crore

Let’s simplify the journey with some numbers. Here’s how much you need to invest monthly at different ages to retire with ₹10 crore, assuming an average annual return of 15%.

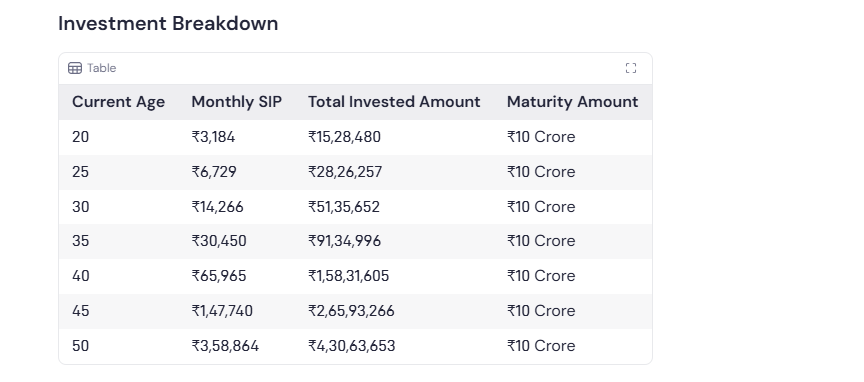

Investment Breakdown

Insights from the Table

- Start Early, Save Less: If you begin investing at age 20, you only need to contribute ₹3,184 every month. As you wait, the required contribution increases significantly, illustrating the advantage of starting young.

- Discipline is Key: The success of SIPs relies heavily on consistency. Whether the market is up or down, maintaining your investment routine can help you attain your target.

3. Flexibility: Don’t worry if your financial situation changes. SIPs allow you to adjust contributions based on your circumstances; just ensure you stick to your long-term goals.

Tips for Successful SIP Investment

Choose the Right Funds: Research and choose mutual funds that align with your risk tolerance and investment horizon. Diversification can also help mitigate risks.

Regularly Review Your Portfolio: Periodically check your investments to ensure they are on track. Adjustments might be necessary, but don’t panic with short-term market volatility.

Stay Informed: Follow financial news and trends. Knowledge empowers you to make informed decisions and recognize opportunities.

Consider Professional Advice: If you feel overwhelmed, consulting a financial advisor can help tailor your investment strategy to fit your personal goals.

The Takeaway

Retiring with ₹10 crore might seem like a daunting target, but with systematic planning, disciplined investing, and a long-term mindset, you can make it a reality. Whether you’re in your 20s or 50s, there’s an optimal SIP amount for you. It’s never too late to start investing for your future—your retirement self will thank you!

Are you ready to take the plunge into mutual funds and make your retirement dreams come true? Let’s get started today! Click here Mutual Fund SIP

Also Read More About : Recent IPOs: A Disappointing Rollercoaster Ride for Investors